'Closing' promotions is a concept that is in all TPM software solutions. Some TPM solutions have a drop-down menu to accomplish this, others use buttons. Some TPM solutions automatically close promotions after a pre-determined amount of time. Regardless of what name is used for this work-flow milestone, the functionality and benefits to CG manufacturers are the same.

Definition: A promotion that is in CLOSED status is considered completed and final. No further activity is expected, including transactions that qualify for discounts, and claims against the promotion.

So why take the time to close every old promotion?

Closing a promotion tells your TPM solution that you don’t anticipate any more settlements, and your finance team should consider this promotion’s results final. Here’s the bonus: The finance team will save time resolving deductions, and you will ‘release’ trade funds that can be redeployed or dropped to the bottom line as profit.

TPM solutions anticipate that you will eventually have to pay (or the customer will short-pay) any amounts that your promotion financially incurred. Your finance team should set funds aside to cover these future, anticipated promotional costs. Often these reserves are called accruals. Maintaining reserves for bills that aren’t paid prevents financial surprises for your company. This is one of the reasons that companies without a TPM solution never really know their financial exposure for trade promotions.

Closing promotions also makes the settlement process easier for the finance team. Closed promotions are not on the list of promotions presented to your team looking for promotions to match to open deductions and short-pays. Not only does this make the list shorter, it also prevents matching a deduction to the wrong event.

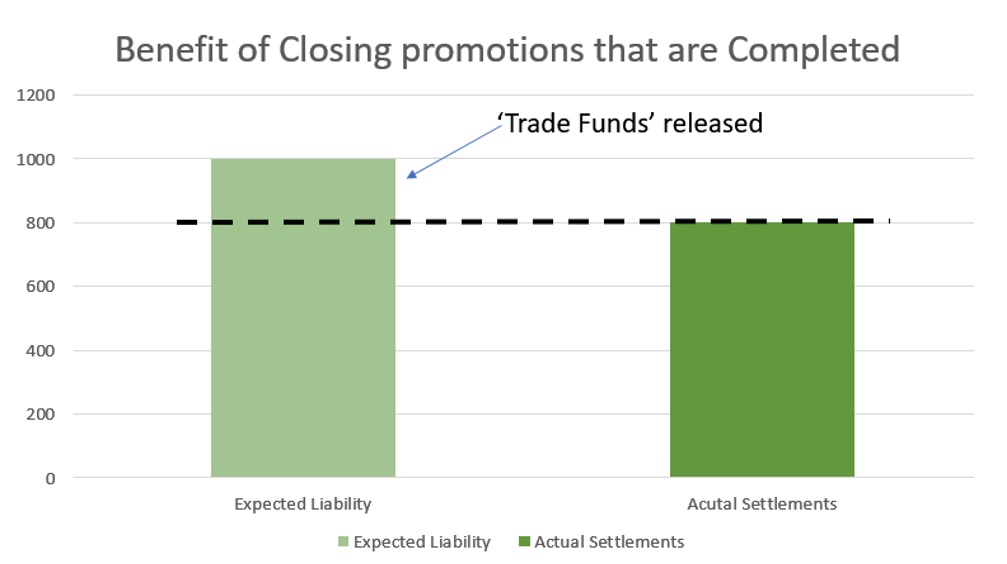

Below is a visual example of a promotion with $800 of Actual Settlements and an Expected Liability of $1,000. Closing this promotion releases $200 of liability, which can be used for other promotions, or dropped to the bottom line as additional profitability. Closing this promotion sets Expected Liability equal to Actual Spending which in this example is $800.

We also know that closing promotions isn’t always perfect. Claims can made months after a promotion’s end date, or after we think all claims have been processed.

If you need to pay or resolve a promotion to a closed promotion, your TPM solution should allow the status to be changed back to Approved. This reverses everything described in our example above. The Expected Liability will go back to $1,000, and the Net Outstanding Liability will go from zero back to $200.

Here are two industry best-practice suggestions for trade promotion management:

- CLOSE your trade promotion when no more payments or claims are anticipated.

- Add a note to the promotion to document why you do not expect any more settlements for your deal

Alex Ring

President

CG Squared, Inc.